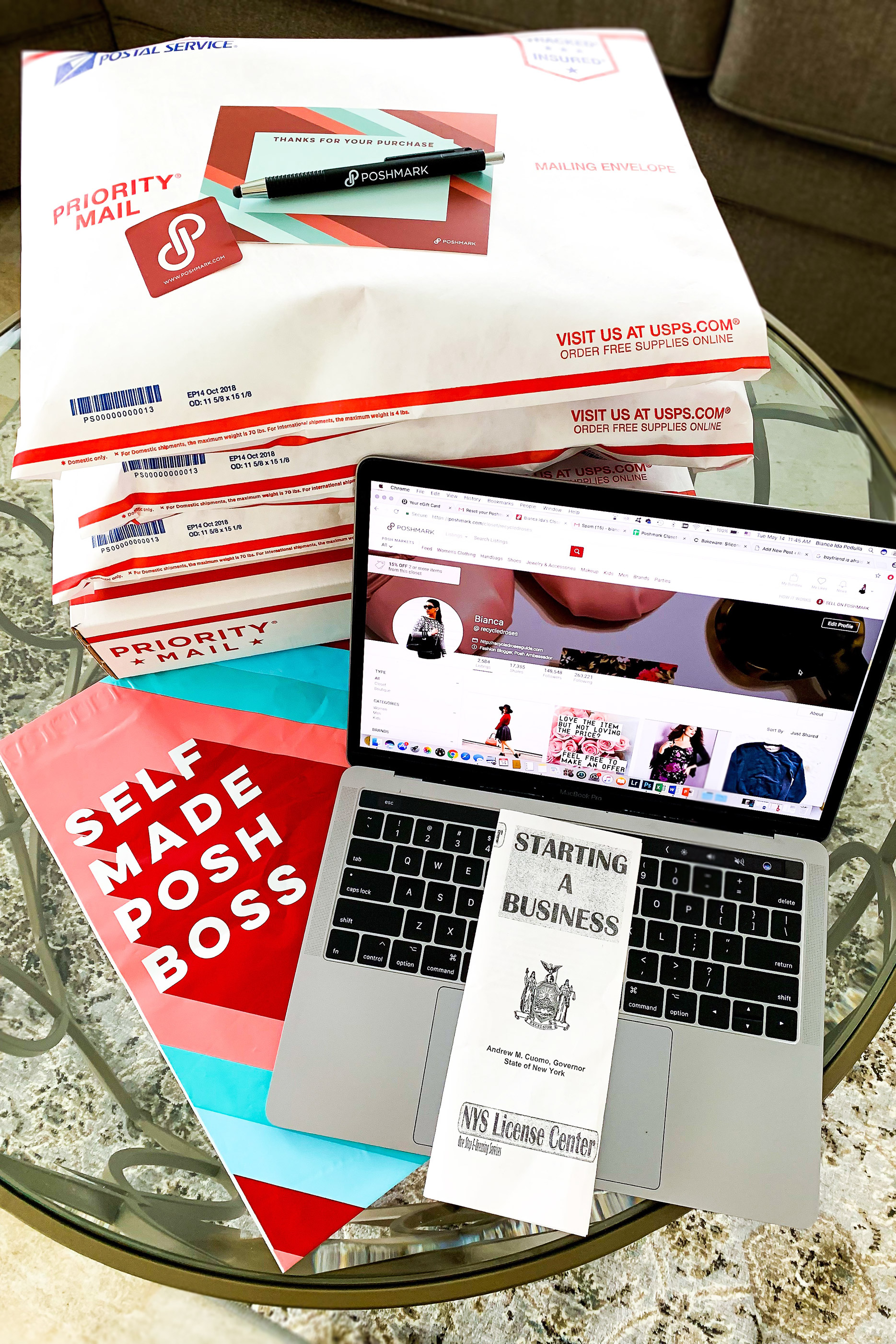

Hi there and welcome! I’ve been on the fence on writing about this topic but after getting such an overwhelming response to do so, I thought, why not?? This is a topic that there is not a whole lot of information about online so I wanted to share some of what I have learned over the past few years about it with you today. I’m going to do this a series over the next few weeks, so please check back every Monday and Wednesday to see what topic I will be covering that day. There is a lot of information to share but hopefully, some of the information that I will be providing will be helpful to you in some way, shape, or form! So let’s get started!

When most people first join Poshmark, they don’t immediately think to themselves, “I should register as a business.” Some do which is amazing but others, like myself did not initially. I think that when most people join the app, they approach it as a hobby and then let things evolve from there, which more times than not, it turns into an actual business. When I first realized that I should probably file as a business, I was so scared and anxious that I would do it wrong. There is little to no information online as far as what to do and it is a little frightening knowing that you could mess up and owe a ton of money to the government. Once I figured it out though, it wasn’t nearly as scary as I thought. Yes, I did owe the government money but I already knew that I would so that didn’t worry me too much.

For today’s post, I wanted to start by helping you decide as to whether or not you should register as a business and help you to put your mind at ease if you do decide to register as one. I do just want to disclose that I live in New York state so some of the information that I will be providing may reference the New York state process. If you live in another state, you may need to make a few tweaks specific to your own state.

Should I Register as a Business or Not?

Let’s discuss the difference between a “hobby” and a “business”…

What Would be Considered a Hobby??

-For your Poshmark use to be considered a hobby, your intent for using the app would be to sell items for less than what was initially paid for them.

-In this situation, you would NOT need to file as a business as you would be treating the app like an online garage sale.

What Would be Considered a Business?

-When your intention for using the app is to make a profit on the items that you sell (you are selling them for more than what you paid)

-Can be part-time (less than 40 hours per week) or full-time (40 hours or more per week)

-In this situation, then YES you would need to file as a business

Do I Really Need to File as a Business?

-In short… yes, you probably do depending on your intent!

-If you are making ANY sort of profit from the app, you should register as a business

-According to the federal government, you are considered a small online auction business and your year-to-end earnings should be reported to the IRS

-You WILL have to pay taxes to the federal and state government during tax season depending on how much money you make and the state you live in

-If you live in New York, you WILL have to pay NYS Sales and Use Taxes quarterly

-Filing as a business isn’t too difficult but there are some steps that you will need to take to have it run as smoothly as possible

I think that this is probably enough to think about for today but stay tuned as next week, I will be discussing:

Steps for Filing as a Business

How to Properly Track your Records

If you don’t already, be sure to check out my Instagram for more Reselling Tips at @ RecycledRosesGuide (Click HERE)

To get email notifications for my next blog post and to receive a Reseller Recap Every Friday, sign up for my emails below:

Be Classy, Be Confident, Be Strong

Baci,

Bianca Ida