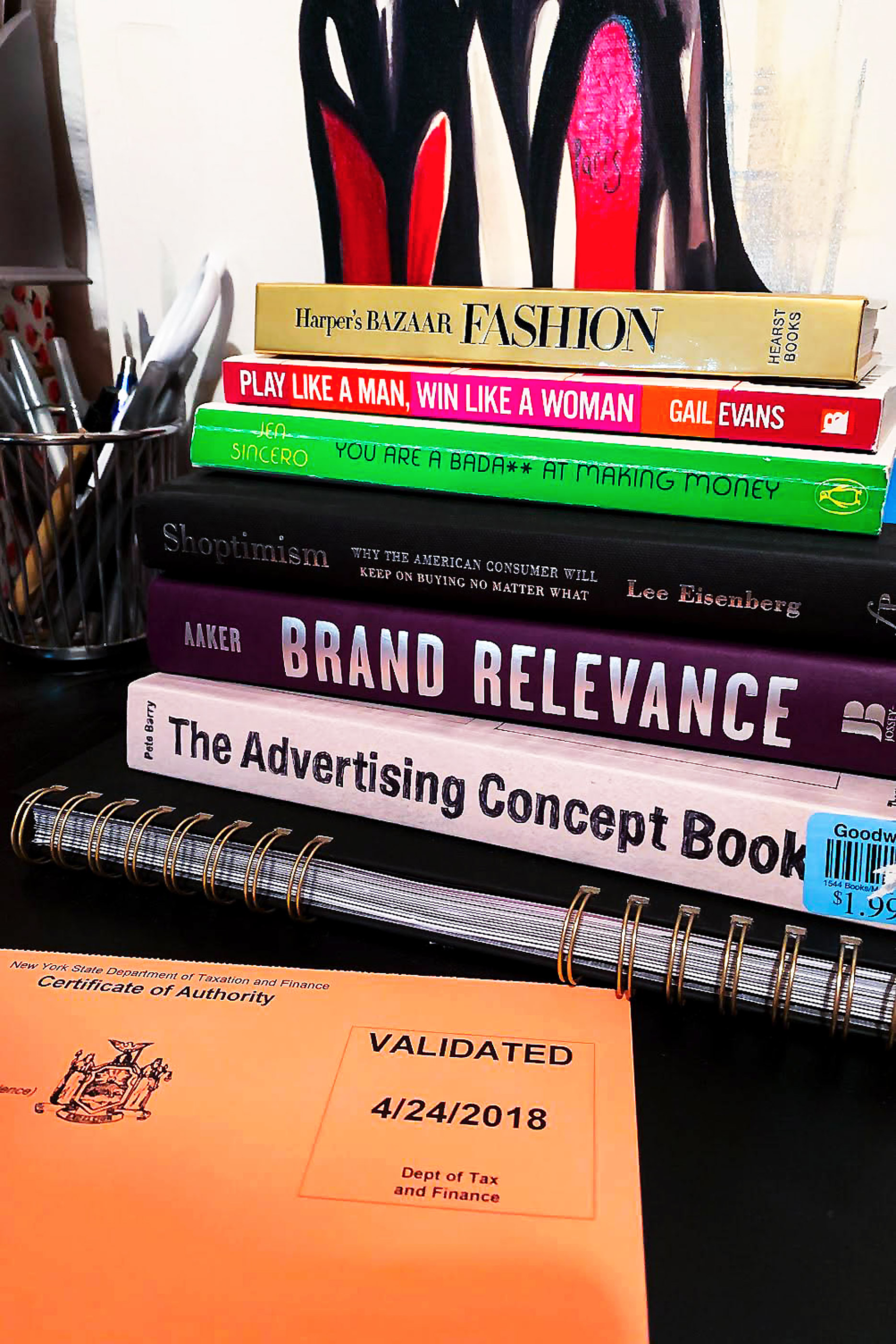

I hope that you found the first post (link HERE) on deciding if you should file your Poshmark closet as a business helpful and I really appreciate you joining me in the second part of this series. Today, I want to walk you through the steps of filing as a business, specifically in New York State. Every state has their own process for this so be sure to research the proper steps for your particular state. Most states follow similar steps to what I will be sharing below but do a little research to see if any additional steps are needed if you live outside of New York.

Again, the information below is a collection of what I have learned through my reselling journey so far from various sources and experiences and some information will vary by state.

Let’s get to it!

Step 1: Naming Your Business/ Obtaining a Business License

*Obtain a Fictitious Business Name (FBN)/ Doing Business As (DBA)

-This is needed if you are doing business under a name different from your given name

Ex: My given name is Bianca Ida, however, I am ”doing business as,” Recycled Roses, as it includes all my social media channel’s, my blog, and my Poshmark closet

*To obtain your FBN/DBA, you may need to visit your county clerk office

-Fill out form, Assumed Name Certificate for an Individual, and pay a fee for it to be notarized

-In NY, you must have this certificate at least 20 days before operating your business

Step 2: Decide on Your Entity Type

*Sole Proprietorship- Owned by one person

Advantages: Can start immediately, easy, and inexpensive; Disadvantages: No personal liability insurance/protection (not really needed as most sellers if you don’t have a brink and mortar store)

*Limited Liability Companies (LLC)- Similar to a Sole Proprietor but provides the liability protection of a corporation

Advantages: Liability Protection; Disadvantages: Costly, additional documentation needed, may need to pay a tax and LLC fee

*There are other entity types available but I just wanted to briefly talk about the two main types that will most likely apply to you

Step 3: Register for an EIN

-Once you have all your business paperwork obtained, you will need to register for the NYS and IRS websites where you will then need to obtain an Employer Identification Number

-This number will be used for tax purposes with the state and federal governments

Step 4: Learn Your State and Federal Government Taxes

-In NYS, you will need to pay quarterly Sales and Use Taxes on Clothing and Footwear. Other states may have other taxes/fees that you may need to pay.

-You can view the NYS quarterly tax calendar and pay your quarterly taxes online at http://www.tax.ny.gov/pay

-You may also need to pay an income tax depending on your situation

-Also, all of your Poshmark profit will need to be reported to the state and IRS at the end of the tax year

I think that this is probably enough to think about for today but stay tuned as later this week, I will be discussing:

How to Properly Track your Records

If you don’t already, be sure to check out my Instagram for more Reselling Tips at @ RecycledRosesGuide (Click HERE)

To get email notifications for my next blog post and to receive a Reseller Recap Every Friday, sign up for my emails below:

Be Classy, Be Confident, Be Strong

Baci,

Bianca Ida